GFM February 2026 Newsletter

6 February 2026

“Momentum Matters: Keep 2026 Moving Forward”

Dear Clients and Friends,

As we move through the year, many households and businesses are feeling the ongoing impact of interest rate changes. Higher borrowing costs, shifting investment returns, and cost-of-living pressures mean financial decisions matter more than ever.

At the same time, superannuation remains a key long-term consideration. Market volatility and legislative settings can influence balances in the short term, but staying informed and focused on strategy is essential for protecting your future retirement outcomes.

Please take the time to review all facets of your current life needs and take action to stay ahead.

As always, we’re here to help you make sense of the numbers and plan with confidence.

Warm regards,

Darren, Brent and the Team

RBA raises cash rate for first time in over 2 years

The Reserve Bank of Australia (RBA) has delivered its highly anticipated February cash rate decision and has raised the official cash rate by 0.25 per cent, this takes the cash rate from its current level of 3.60 per cent to 3.85 per cent.

What this means:

- If you’re on a variable rate loan structure, your mortgage repayments may increase.

- New loans and refinances could be impacted with higher interest rates.

- Higher repayment commitments may reduce funds available for everyday expenses.

- Have your borrowing capacity re-assessed

Payday Super will be here in the blink of an eye.

148 days left!!

We remind you that the SBSCH will close permanently on 1 July 2026.

So, here are 3 tips to perfecting Payday Super

# 1: Plan your transition

- Set a start date. Payday Super starts from 1 July. You don’t need to wait to get ready.

- Talk to us if you’re unsure about the best time for your business to transition.

#2: Prepare your business

- Review your cashflow & update your business processes

- Set up a process to quickly correct any errors.

#3: Progress your payday plans

- Confirm when your software will be ready. Check with your digital service or payroll provider.

With a new super system there’s a lot you need to know, so we will always be here to help you.

We encourage you to review the ATO’s how to transition from the Small Business Super Clearing House to your new provider.

Another useful tool is the ATO’s Payday Super checklist for Employers resources page.

Additional Information and resources can also be found here

AI Tax Tips: Helpful Shortcut or Costly Trap?

Many business owners and investors now turn to AI tools like ChatGPT for quick answers on tax and super. The responses are fast, confident and free — but they aren’t always correct.

Australia’s tax system is complex and highly dependent on individual circumstances. While AI can explain basic concepts, it cannot apply judgement or consider your full financial position. Relying on it for advice can lead to incorrect claims, breaches of contribution caps, outdated information and, ultimately, ATO audits, interest and penalties.

We’re increasingly seeing the consequences when AI guidance goes wrong. A recent Administrative Review Tribunal case even criticised a taxpayer for relying on AI-generated legal references that were inaccurate or irrelevant — wasting both time and resources.

Superannuation is particularly high risk, with strict rules that AI often overlooks. There is also a privacy concern: entering sensitive financial data into AI platforms means losing control over how that information may be stored or used.

The bottom line: AI is a useful starting point, but it is not a substitute for tailored professional advice. Before acting on AI-generated information, please reach out to us first— it’s almost always cheaper than fixing a mistake later.

What is involved with an SMSF

Starting a self-managed super fund (SMSF) can be appealing, but it comes with significant responsibilities.

From the outset, you’ll need to appoint trustees, establish the trust and investment strategy, register with the ATO, and set up banking. Once operating, trustees must manage rollovers and contributions, invest within strict rules, regularly review the strategy, and keep detailed records.

Each year brings further obligations — valuing assets, preparing financial statements, arranging an independent audit, lodging an annual return, and paying any tax and levies. When members begin drawing benefits, trustees must ensure minimum payments are met and all reporting requirements are satisfied. Even closing the fund involves audits, final returns, settling tax, and distributing assets.

The bottom line: SMSFs offer control, but they demand time, discipline, and compliance. Even with professional support, trustees remain legally responsible — so it’s important to weigh the commitment before deciding if an SMSF is right for you.

If you are thinking about setting up an SMSF contact us to discuss your personal situation and guide you in the right direction.

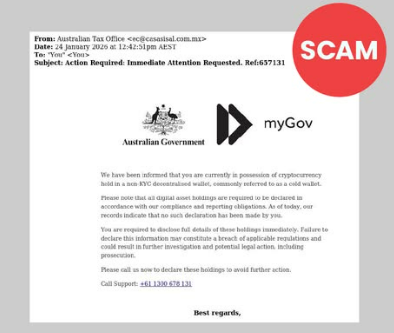

Cryptocurrency Scam Alert

Beware of a new crypto email scam.

The scammers are pretending to be from the ATO or from myGov. If you receive an email asking you to confirm you are holding cryptocurrency by calling a phone number:

*Do not respond

*Do not call the number

*Do not provide any information

*Do not open attachments.

Key Dates

- Lodge and Pay December 2025 Quarterly BAS – 3rd March 2026

- Lodge and Pay January 2026 Payroll Tax – 9th February 2026

- Lodge and Pay January 2026 Monthly BAS/IAS – 23rd February 2026

- Lodge and Pay February 2026 Payroll Tax – 9th March 2026